Conoce todo sobre trámites de aduana en inglés en Perú: Guía completa para importadores y exportadores

Customs Procedures in Peru

When importing goods into Peru, it is important to understand the customs procedures to ensure a smooth process. The customs regulations in Peru include documentation requirements, duties, and taxes that must be paid for imported goods.

One of the key steps in the customs process is the submission of the required documentation, which typically includes a commercial invoice, packing list, and a bill of lading or airway bill. Additionally, depending on the type of goods being imported, permits or certificates may also be necessary.

It is important to be aware of the customs duties and taxes that apply to imported goods in Peru. These can vary depending on the type of goods, their declared value, and their country of origin. Understanding and fulfilling these financial obligations is essential to prevent delays and potential fines.

In order to facilitate the customs clearance process, it is advisable to work with a reputable customs broker who is familiar with the specific requirements and procedures in Peru. They can provide valuable assistance in preparing the required documentation, calculating duties and taxes, and navigating the customs clearance process efficiently.

Understanding the Importance of Customs in International Trade

El manejo adecuado de las aduanas es esencial para facilitar el comercio internacional. En el contexto de Perú, comprender la importancia de las aduanas en el intercambio de bienes es crucial para garantizar la eficiencia y legalidad en las operaciones comerciales. Las aduanas desempeñan un papel fundamental en la regulación y supervisión de las mercancías que ingresan y salen del país, asegurando el cumplimiento de las normativas aduaneras y fiscales.

La correcta gestión aduanera no solo garantiza el cumplimiento de las regulaciones comerciales internacionales, sino que también contribuye a la seguridad y protección de la sociedad. A través de una adecuada clasificación arancelaria y declaración de mercancías, se promueve la transparencia y el control en el flujo de bienes, evitando el contrabando y asegurando el cumplimiento de los impuestos y aranceles correspondientes.

En el contexto global, las aduanas son un punto crucial para la competitividad y el desarrollo económico de un país. Una gestión eficiente de las aduanas promueve la agilidad en las operaciones comerciales, reduciendo los costos y tiempos de importación y exportación. Además, fomenta la confianza entre los socios comerciales internacionales, fortaleciendo las relaciones bilaterales y el posicionamiento del país en el mercado global.Sure, here’s the SEO content for the H2 in HTML:

Streamlining Your Imports and Exports through Peruvian Customs

When it comes to managing imports and exports through Peruvian customs, streamlining the process is essential for businesses. Understanding the regulations, documentation requirements, and import/export procedures can significantly impact the efficiency and cost-effectiveness of your international trade operations.

Peruvian customs can be complex, but with the right knowledge and support, businesses can navigate the process smoothly and avoid delays or complications. Whether you are importing goods into Peru or exporting products to international markets, optimizing your customs procedures can help save time and resources while ensuring compliance with all relevant regulations.

By leveraging the expertise of customs brokers and staying informed about the latest customs policies and procedures, businesses can enhance their import and export operations, minimize risks, and maximize opportunities for growth in the global market.

Key Documents Required for Customs Clearance in Peru

The key documents required for customs clearance in Peru include the commercial invoice, bill of lading, packing list, and any applicable certificates of origin. These documents provide essential information about the goods being imported, their value, quantity, and origin. The commercial invoice should include details of the seller and buyer, a detailed description of the goods, and their value in the currency of the transaction. The bill of lading serves as a receipt of shipment and a document of title to the goods.

In addition, a packing list detailing the contents of each package, including weight and dimensions, is necessary for customs clearance. Furthermore, specific goods may require certificates of origin to qualify for preferential tariffs or to comply with import regulations. Ensuring all these key documents are accurately prepared and provided is essential for a smooth customs clearance process in Peru. Compliance with these requirements is crucial for avoiding delays and ensuring the efficient movement of goods through the customs process.

Additional documents may be required based on the nature of the goods, their classification, and any specific regulatory requirements. It’s important for importers to work closely with their customs broker or freight forwarder to ensure all necessary documentation is in order before the goods arrive in Peru.

Navigating the Complexities of the Customs Process in Peru

“`html

When it comes to importing goods to Peru, navigating the customs process can be a complex and daunting task. Understanding the regulations and requirements set forth by the Peruvian customs authority is essential for a smooth and successful import process.

From obtaining the necessary documentation to complying with specific import restrictions, there are several crucial steps that importers must take to navigate the customs process in Peru effectively. An in-depth knowledge of tariff classifications, valuation methods, and duty rates is also essential to ensure compliance with the customs regulations.

Furthermore, working with experienced customs brokers or import specialists can provide invaluable assistance in navigating the complexities of the customs process in Peru. These professionals can offer guidance on documentation, tariff classifications, and customs clearance procedures, ultimately streamlining the import process and minimizing potential delays or complications.

“`

Lo más buscado:

Cómo Obtener el Código de la Unidad Ejecutora: Guía Completa para Trámites en Perú

Cómo Obtener el Código de la Unidad Ejecutora: Guía Completa para Trámites en Perú  Todo lo que necesitas saber sobre la boleta de pago electrónica en el MINSA en Perú: trámites, requisitos y más

Todo lo que necesitas saber sobre la boleta de pago electrónica en el MINSA en Perú: trámites, requisitos y más  Descarga Gratis el Modelo de Carta Poder en Word – Formato Legal para Perú

Descarga Gratis el Modelo de Carta Poder en Word – Formato Legal para Perú  Guía completa: Cómo solicitar donaciones en Perú de manera eficaz

Guía completa: Cómo solicitar donaciones en Perú de manera eficaz  Nombres de Padres por DNI en Perú: Cómo Obtener esta Información y Realizar Trámites

Nombres de Padres por DNI en Perú: Cómo Obtener esta Información y Realizar Trámites  Descubre cómo averiguar el nombre de tus padres con tu DNI en Perú: Guía paso a paso

Descubre cómo averiguar el nombre de tus padres con tu DNI en Perú: Guía paso a paso  Cómo Calcular el FOB en Perú: Guía Paso a Paso para tus Trámites de Exportación

Cómo Calcular el FOB en Perú: Guía Paso a Paso para tus Trámites de Exportación  Envío de Precios Digemid: Todo lo que Necesitas Saber para Realizar tus Trámites en Perú

Envío de Precios Digemid: Todo lo que Necesitas Saber para Realizar tus Trámites en Perú  ¿Es posible emitir un recibo por honorarios con fecha anterior en Perú? Todo lo que necesitas saber

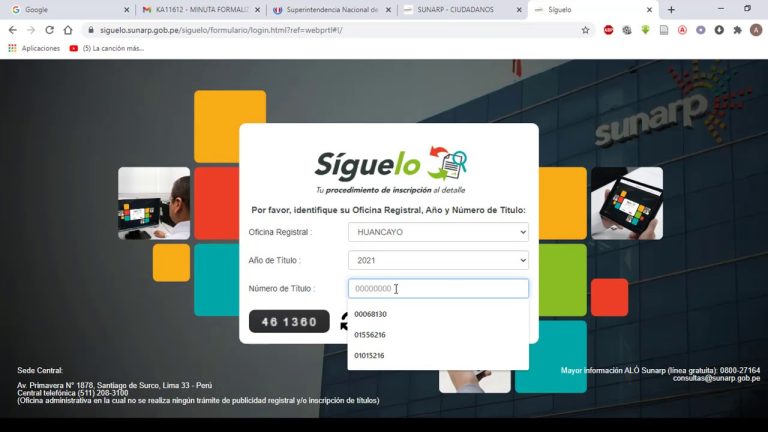

¿Es posible emitir un recibo por honorarios con fecha anterior en Perú? Todo lo que necesitas saber  Sunarp Consulta Vehicular por DNI: Todo lo que necesitas saber para realizar trámites de manera sencilla en Perú

Sunarp Consulta Vehicular por DNI: Todo lo que necesitas saber para realizar trámites de manera sencilla en Perú